43 what is coupon payment of a bond

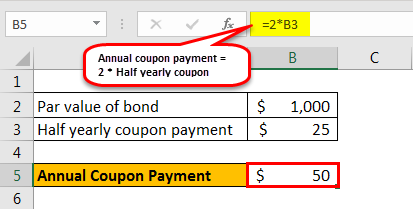

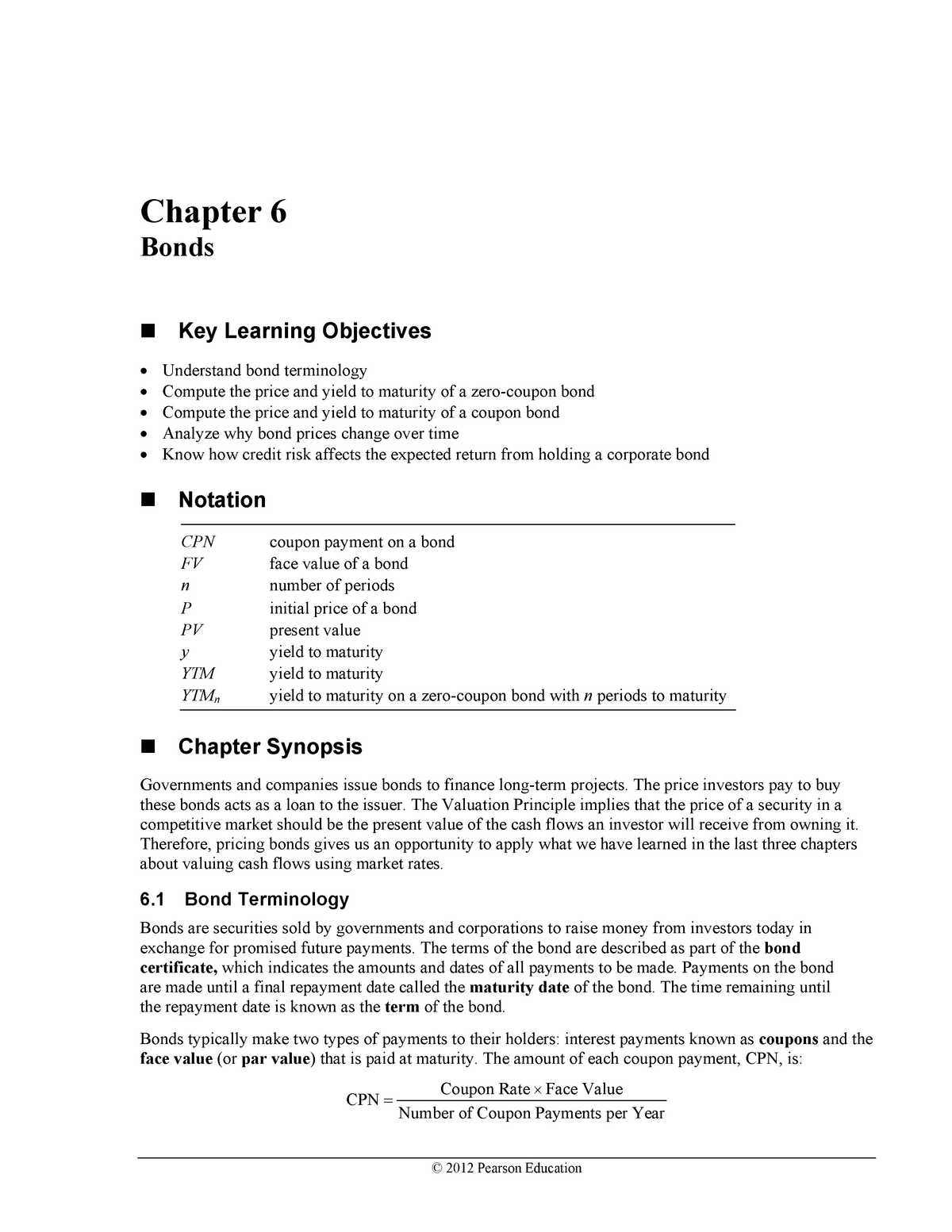

Zero-Coupon Bond: Definition, How It Works, and How To Calculate Verkko31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... How to Calculate a Coupon Payment: 7 Steps (with Pictures) Verkko25.11.2022 · Use the current yield to calculate the annual coupon payment. This only works if your broker provided you with the current yield of the bond. To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value).

Coupon Payment | Definition, Formula, Calculator & Example Verkko27.4.2019 · A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In …

What is coupon payment of a bond

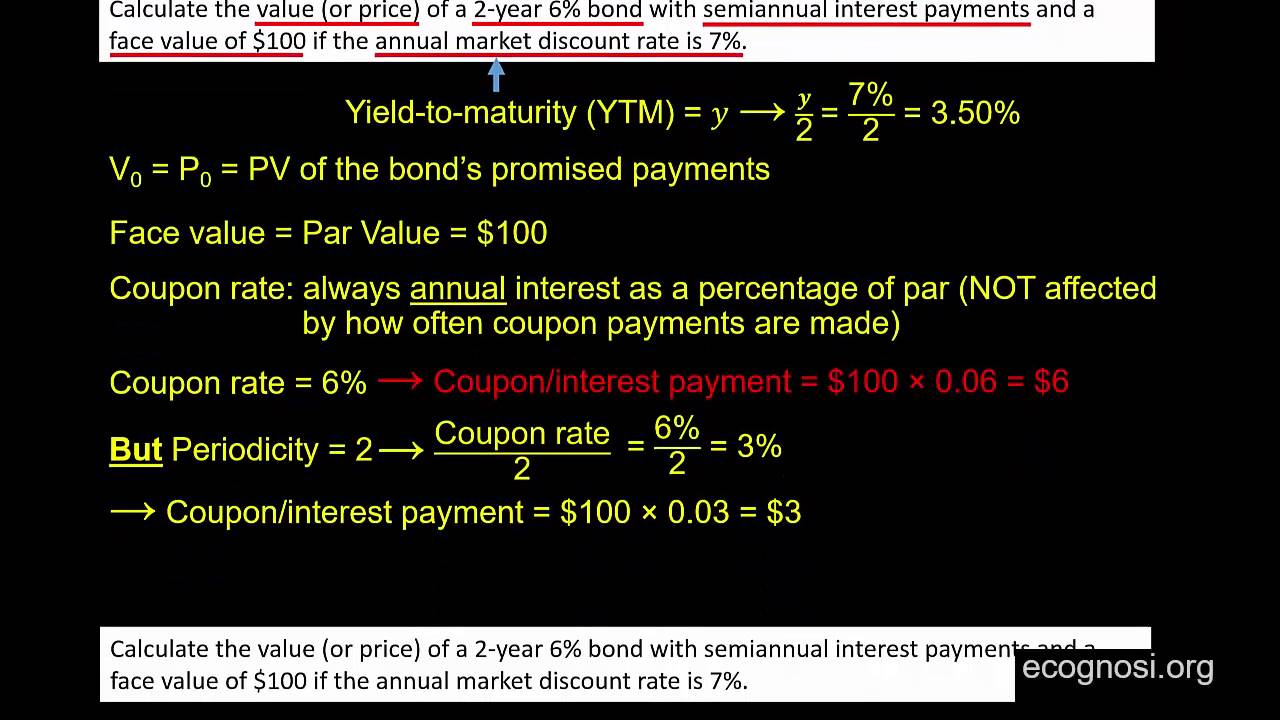

Zero-coupon bond - Wikipedia VerkkoA zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of … How to Calculate an Interest Payment on a Bond: 8 Steps Verkko10.12.2021 · Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. For example, you may see a 5% coupon on a bond with a face value of $1000. In this case, the coupon would be $50 (0.05 multiplied by $1000). It is important to remember the … Coupon (finance) - Wikipedia VerkkoIn finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 …

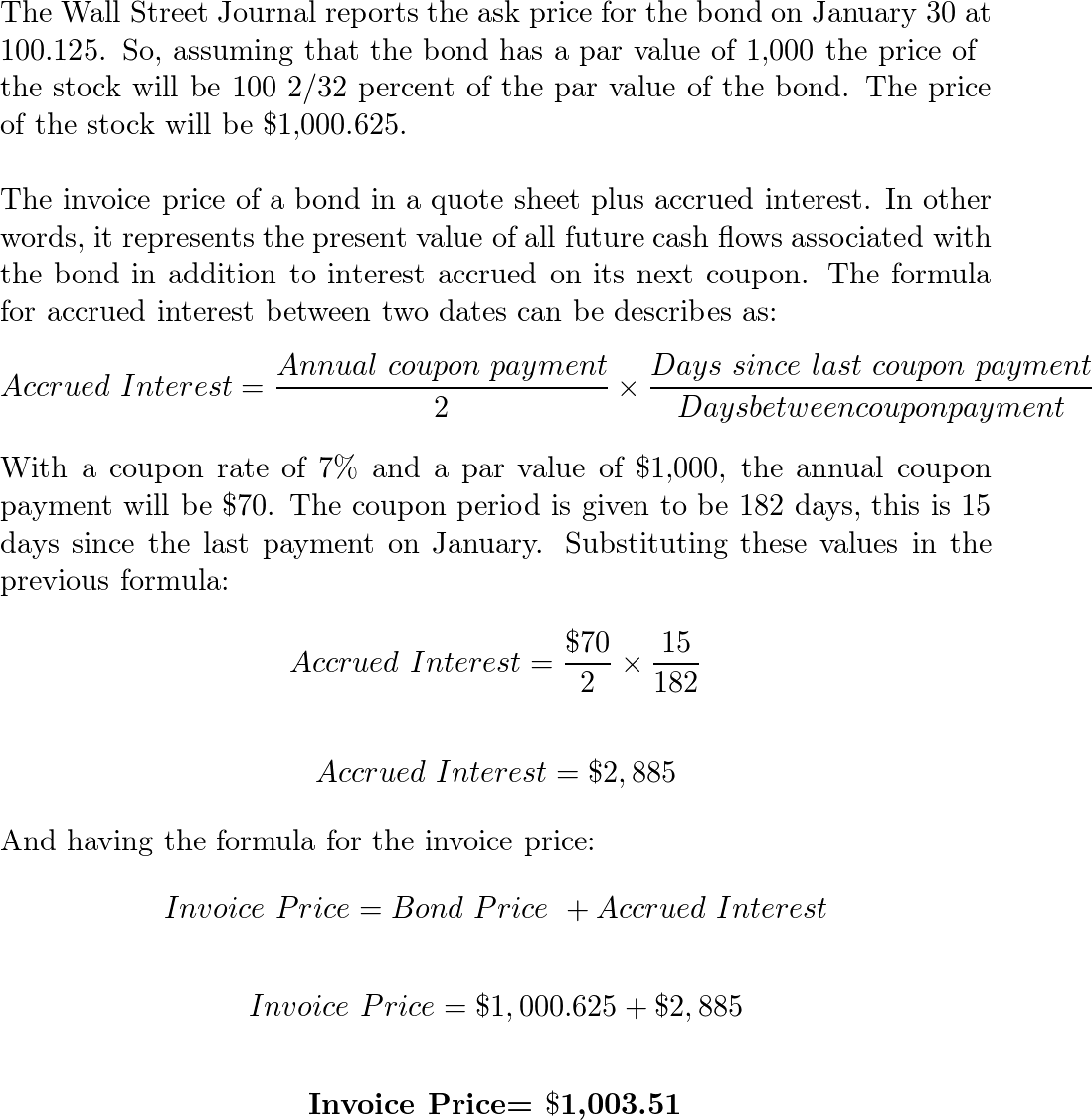

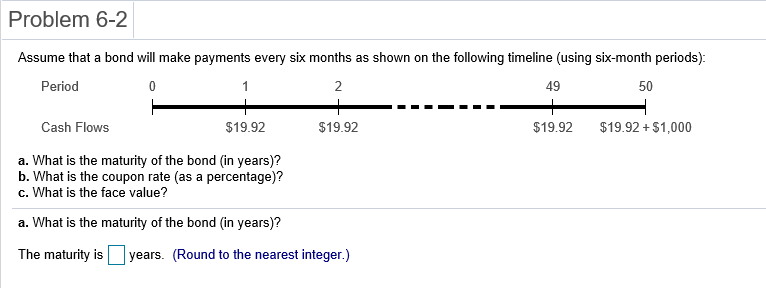

What is coupon payment of a bond. Coupon Bond: Definition, How They Work, Example, and Use Today Verkko31.3.2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Bond (finance) - Wikipedia VerkkoIn finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less … Yield to Maturity (YTM): What It Is, Why It Matters, Formula Verkko31.5.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Loan Calculator VerkkoDeferred Payment Loan: Single Lump Sum Due at Loan Maturity. Many commercial loans or short-term loans are in this category. ... Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value.

Coupon (finance) - Wikipedia VerkkoIn finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 … How to Calculate an Interest Payment on a Bond: 8 Steps Verkko10.12.2021 · Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. For example, you may see a 5% coupon on a bond with a face value of $1000. In this case, the coupon would be $50 (0.05 multiplied by $1000). It is important to remember the … Zero-coupon bond - Wikipedia VerkkoA zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of …

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

Post a Comment for "43 what is coupon payment of a bond"