42 coupon on a bond

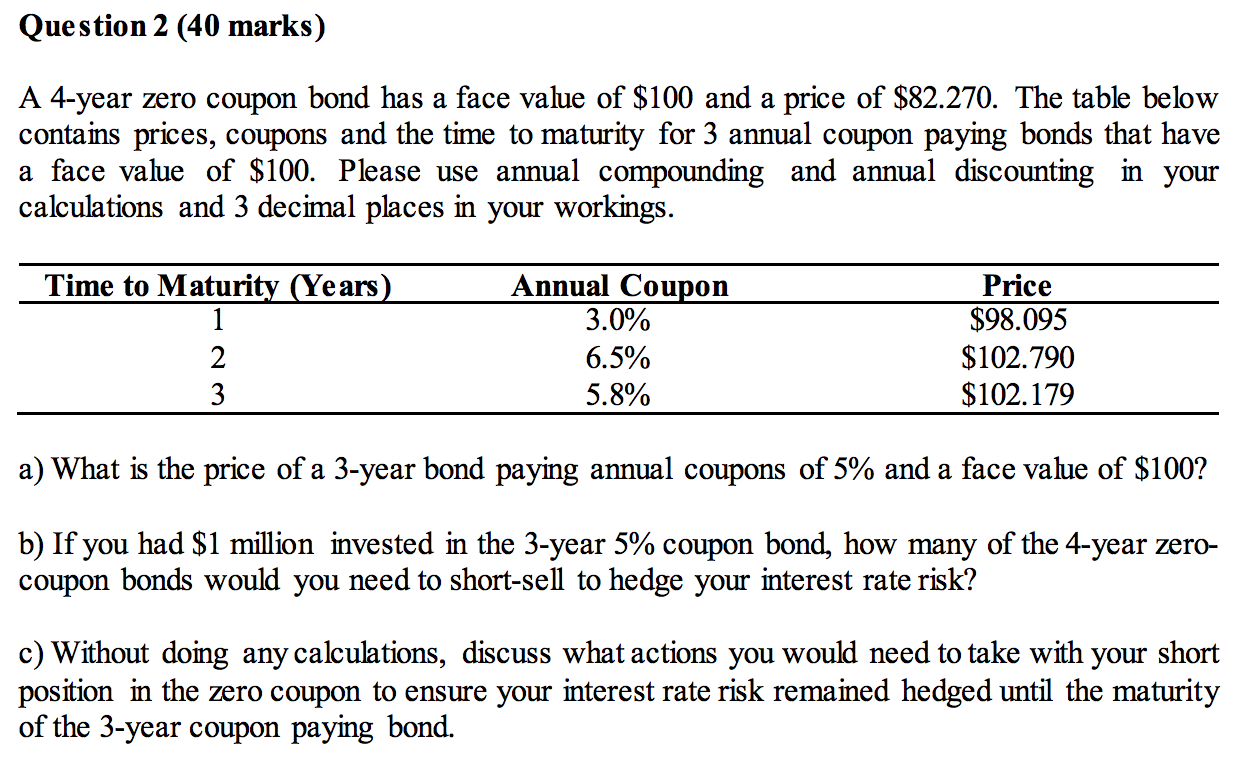

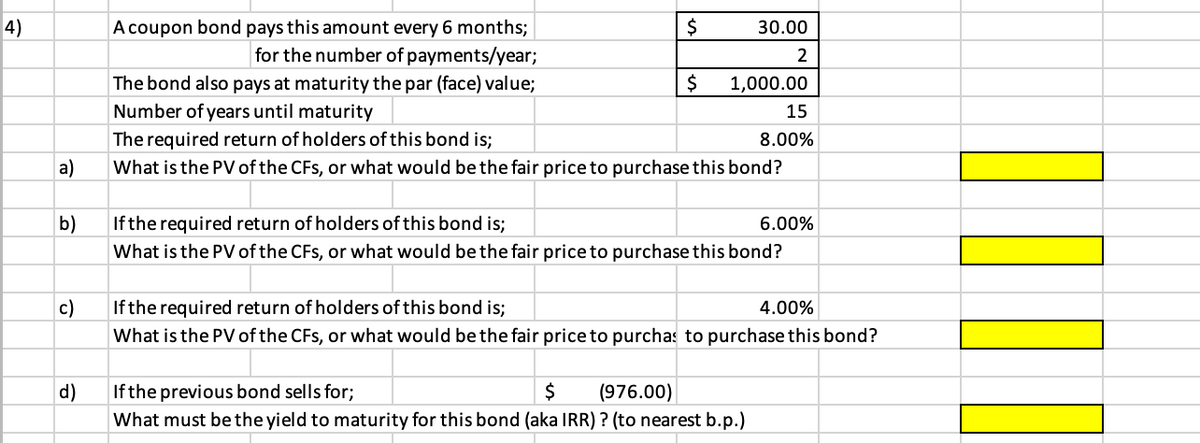

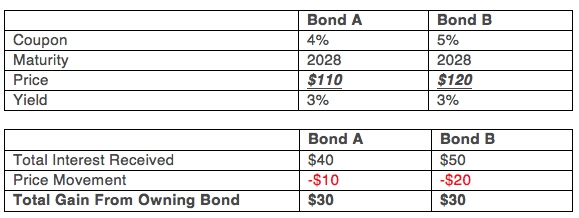

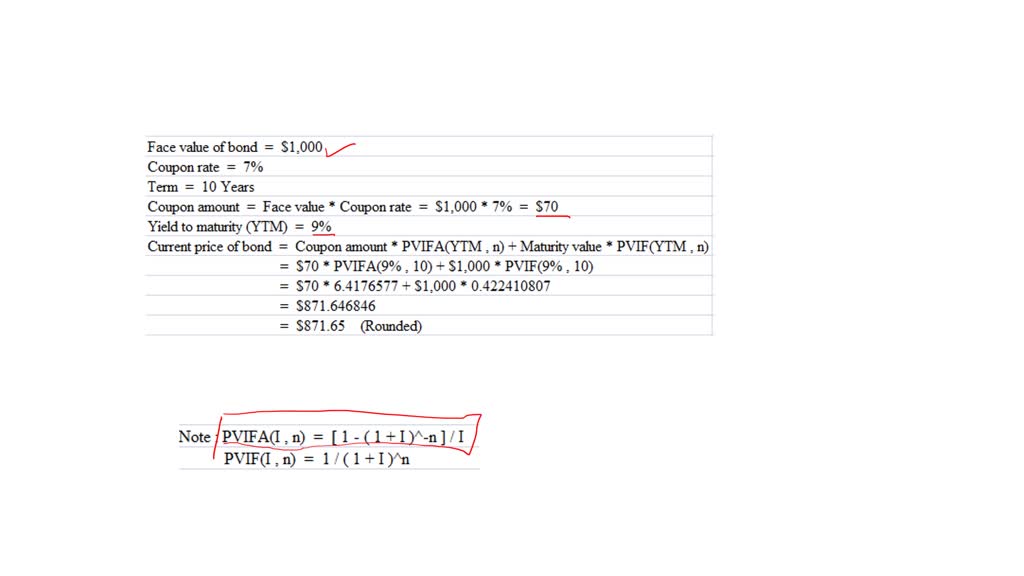

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Bond - Investopedia Mar 31, 2020 · A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are...

What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Coupon on a bond

What Is a Bond Coupon? - The Balance Mar 04, 2021 · A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Coupon Bond - Guide, Examples, How Coupon Bonds Work Oct 13, 2022 · A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond’s yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment.

Coupon on a bond. Coupon Bond - Guide, Examples, How Coupon Bonds Work Oct 13, 2022 · A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond’s yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. What Is a Bond Coupon? - The Balance Mar 04, 2021 · A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Post a Comment for "42 coupon on a bond"