38 advantage of zero coupon bond

› terms › cConvertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ... Advantages Of Zero Coupon Bond - bizimkonak.com Zero Coupon Bonds - Taxation, Advantages. CODES (1 days ago) A zero-coupon bond is a preferred investment option since it is secured, especially if invested for the long term. Some of the benefits that these offers are: Predictable … Visit URL. Category: coupon codes Show All Coupons

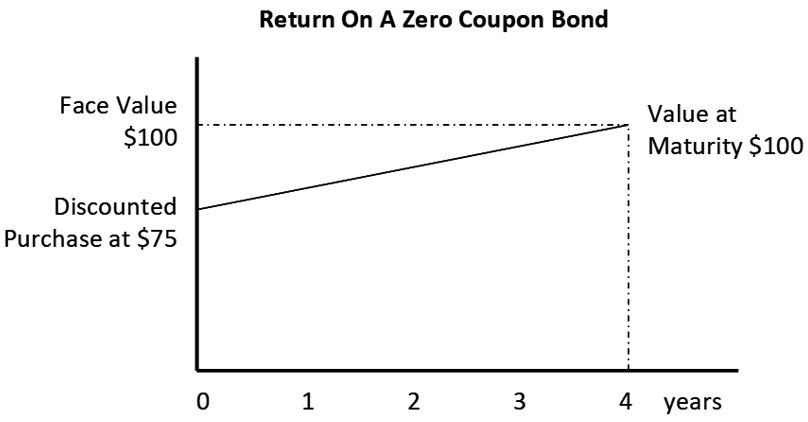

Learn About Zero Coupon Bond | Chegg.com A zero-coupon bond is a debt security that sells without an expressed coupon rate. These bonds are sold at deep discounts and do not pay monthly interest as typical bonds do.This way, the bond issuer does not need to worry about interest rate changes, and the investors receive a lump sum amount at maturity rather than regular coupon interest.. Bond issuers give out bonds to finance their long ...

Advantage of zero coupon bond

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them... Advantages and Risks of Zero Coupon Treasury Bonds Unique Advantages of Zero-Coupon U.S. Treasury Bonds Funds zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect forebear holdings at precisely the right time. The responsiveness of bond prices to interest rate changes increases with the schedule to maturity and decreases with interest payments. investinganswers.com › dictionary › yYield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we’ll use the formula mentioned above: The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don’t have recurring interest payments, they don’t have a coupon rate.

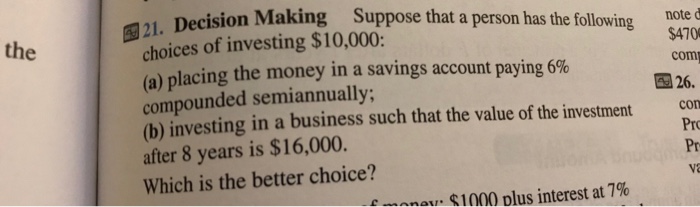

Advantage of zero coupon bond. The best advantage of a zero-coupon bond to the issuer is that the ... The best advantage of a zero-coupon bond to the issuer is that the. Bond requires a low issuance cost. Bond requires no interest income calculation to the holder or issuer until maturity. Interest can be amortized annually by the APR method and need not be shown as an interest expense to the issuer. Interest can be amortized annually on a ... en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce the interest rate that must be offered in order to sell the bond issue. Example. Price paid for bond with warrants ; Coupon payments C; Maturity T; Required rate of return r; Face value of bond F Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond vs. Regular Coupon Bearing Bond Advantages #1 - Predictability of Returns #2 - Removes Reinvestment Risk #3 - Longer Time frame Disadvantages #1- Illiquid Secondary Markets #2 - High Duration and Interest Rate Risk #3 -No Regular Income Recommended Articles Explanation Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom This is because zero coupon bonds can help in securing a guaranteed return at the end of a fixed time period. Since these bonds offer discounts for longer investment tenures, they are ideal for those who have long-term investment plans. What are the benefits of investing in Zero-Coupon Bond?

smartasset.com › investing › face-value-of-a-bondWhat Is the Face Value of a Bond? - SmartAsset Jan 15, 2020 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date. The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates. Zero-Coupon Bond Definition - Investopedia Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price, much more so than coupon bonds. 1 A bond is a portal through which a corporate or governmental body... Zero coupon bonds what are the advantages and - Course Hero 1. Zero-Coupon Bonds. What are the advantages and disadvantages to a firm that issues low- or zero-coupon bonds? ANSWER: From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest ...

› calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Long-time horizon: The long time horizon of the Zero Coupon bond is a significant advantage for long-term investors. A fixed amount can be availed via a long-term investment without worrying about any market turmoil. Disadvantages of Zero-Coupon Bonds What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Zero coupon bonds are fixed income securities that don't pay any interest. At the time of maturity, the investor is paid the face value or par value. These bonds come with 10-15 years maturity. Hence, they trade at a deep discount. The bond pricing varies with time to maturity . The higher the time until maturity, lower will be the price the ...

What Is a Zero Coupon Bond? | The Motley Fool Over the 10 years, and you will collect a total of $30 in interest, plus, at the end of the term, the company pays you back your initial $100 investment. In contrast, with a zero coupon bond with ...

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Zero-Coupon Bonds facilitates the reliable source for fixed returns provided you keep our investment until maturity. A fixed return can be earned without worrying of the market chaos. No Reinvestment Risks Zero-Coupon Bonds helps you avoid reinvestment risks. With Zero-Coupon Bonds there is no periodic coupon payment.

Pros and Cons of Zero-Coupon Bonds | Kiplinger Their big advantage is that you know how much you'll collect a certain number of years from now. In mid June, for example, you could have bought a U.S. Treasury zero for $341 that matures in August...

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. The...

Zero-Coupon Bond - an overview | ScienceDirect Topics Zero-coupon bonds linked to the inflation do not pay coupons. Therefore, the unique adjustment is made to the principal. These types of bonds offer no reinvestment risk due to the absence of coupon payments and have the longest duration than other inflation-linked bonds. The value is given by Equation (6.8): (6.8)

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

What are the advantages and disadvantages of zero-coupon bond? Originally Answered: What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

Who can issue zero-coupon bonds? - Drinksavvyinc.com What is the primary advantage of zero-coupon bonds for an issuer? They offer a predictable payout The other big advantage of zero-coupon bonds is their predictability. If these bonds are held to maturity, you're guaranteed a return of the full face value. Plus, you'll have gotten a deal: paying less now for more later.

Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia A zero-coupon bond is a type of bond that earns no interest during its lifetime. A zero-coupon bond is issued with a sudden reduction in par value or face value, which is the amount that will be paid for the bond at maturity. An investor receives a one-time interest payment at maturity equal to the difference between the face value and the ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

For zero coupon bonds? Explained by FAQ Blog A zero-coupon bond is a discounted investment that can help you save for a specific future goal. A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs at a foreseeable time. ...

Theorem 4.9 (Option on a zero-coupon bond in the Vasicek model). In the Vasicek model, the price of a European call option with strike K and maturity T and written on a zero-coupon bond with maturity S at time t ∈ [0,T] is given by ZBC(t,T,S,K)=P(t,S)Φ(h)−KP(t,T)Φ(h−σ˜), where σ˜ = σ 1−e−2k(T−t) 2k B(T,S) and h = 1 σ˜ ln P ...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc.

investinganswers.com › dictionary › yYield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we’ll use the formula mentioned above: The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don’t have recurring interest payments, they don’t have a coupon rate.

Post a Comment for "38 advantage of zero coupon bond"